Intel shares jumped by seven per cent in extended trading on Thursday after the tech giant reported stronger-than-expected third-quarter earnings and forecast higher-than-estimated revenue for the upcoming quarter. The surprising results come amid one of Intel's most significant restructuring efforts in its 56-year history.

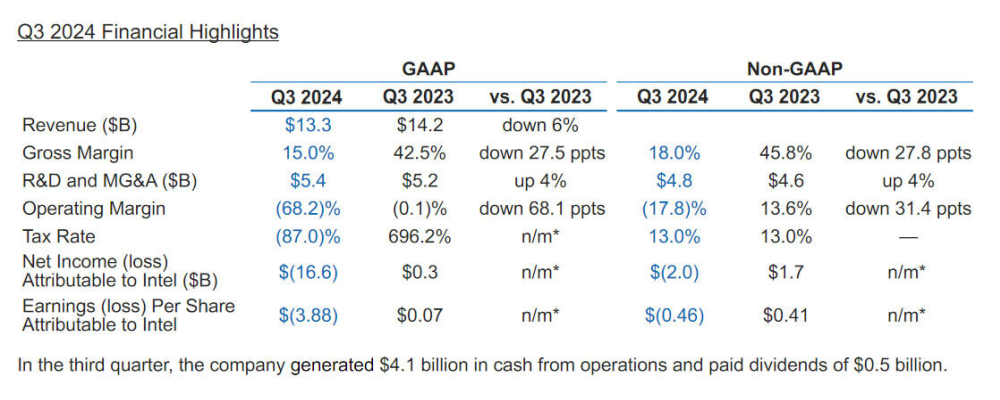

Intel’s adjusted earnings per share stood at 17 cents, surpassing the anticipated loss of two cents. Revenue hit $13.28 billion, above the consensus forecast of $13.02 billion by LSEG. However, the company’s revenue reflected a six per cent year-on-year decline as Intel grapples with a protracted downturn due to market share losses and challenges in breaking into artificial intelligence (AI) markets.

As part of its aggressive cost-reduction plan, Intel recorded restructuring charges of $2.8 billion in the quarter ending 28 September. Additionally, $15.9 billion in impairment charges were noted, including costs related to accelerated depreciation for Intel’s “Intel 7” process node assets and a goodwill impairment in the Mobileye unit.

CEO Pat [kicking] Gelsinger stated, “The company is carrying out one of the most seminal restructuring processes since its establishment in 1968.”

Intel’s board recently approved additional cost-cutting and capital reduction measures, including slashing its headcount by 16,500 employees and reducing its real estate footprint—a move initially announced in August. The restructuring is set to conclude by the end of 2025.

One notable strategic shift during the quarter was Intel’s decision to transform its foundry business into an independent subsidiary, which Gelsinger suggested would provide the unit with outside funding options.

The company’s core Client Computing Group, primarily selling PC chips, reported $7.33 billion in third-quarter revenue, down seven per cent from the previous year and below the $7.39 billion StreetAccount estimate.

Intel CFO Dave Zinsner addressed inventory concerns on a call with analysts, saying, “We anticipate inventory normalisation will continue through the first half of next year.”

On a brighter note, revenue from Intel's Data Center and AI segment rose by nine percent year-on-year to $3.35 billion, outpacing analysts’ projections of $3.17 billion.

Chipzilla provided optimistic guidance for the fourth quarter, forecasting adjusted earnings of 12 cents per share and revenue between $13.3 billion and $14.3 billion, both above market expectations.

Intel is still facing difficulties in the AI market. Although it launched the Xeon 6 server processors and Gaudi AI accelerators during the quarter, uptake for the Gaudi accelerators is slower than an asthmatic ant with a heavy load of shopping and Chipzilla will fall short of its $500 million revenue goal for 2024, Gelsinger acknowledged.

Intel’s share price is still down by around 57 per cent, contrasting with the S&P 500, which has gained 20 per cent in the same period.

However, the recent positive earnings report could signal the beginning of a turnaround as Intel aims to regain its footing in the AI and semiconductor markets and shake off the curse of Mike Mageek who thought Chipzilla was doomed.